John R. Dundon II, EA

Decoding the IRS – Document 6209

Understanding what you are up against with the IRS can be frustrating on many levels....

Form 5500 Pension Plan Penalty Filing Relief

For those of you like me presently wrestling with this issue the IRS recently came...

S – Corp Charitable Donations

The most intriguing aspect of maintaining this tax blog is the pleasure of meeting and...

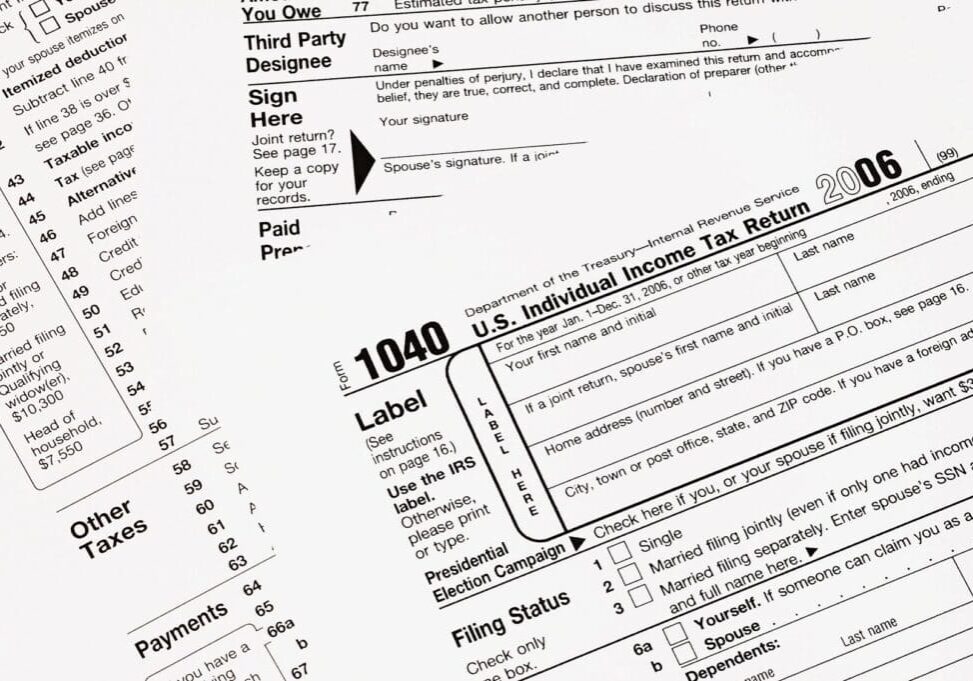

Application for Automatic Extension of Time To File U.S. Individual Income Tax Return – IRS Form 4868

Everyone starts getting a little freaked out this time of year because of personal income...

Retirement Plan Recharacterization

Retirement Plan Recharacterization meansaccording to Reg. Sec. 1.408A-5 that if you make a contribution to...