Tax Deductible Expenses

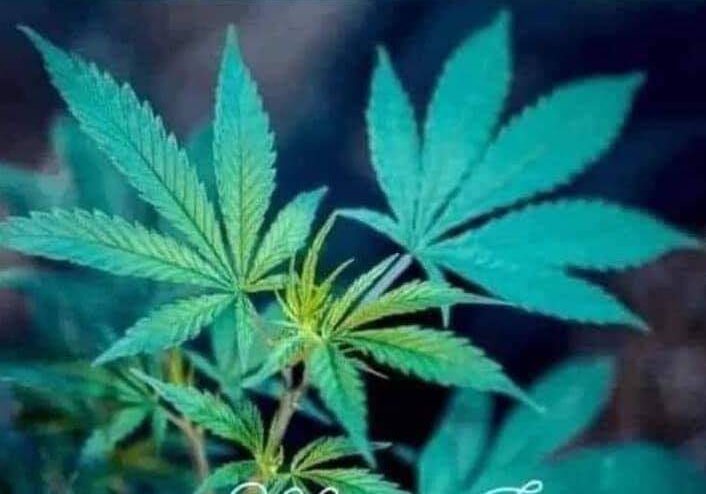

Marijuana Taxation: Beck v. Commissioner & Excise Tax Paid

UGH! I vowed to stop writing about the tax implications of marijuana taxation: Beck v....

Defining Small Employer with Regards to Offering Health Insurance

Many business owners of all sizes have been posting to this blog lately with concerns...

Meal Expense – Navigating Between Internal Revenue Code Sections 162, 274, 132; IRS Technical Advice Memorandum 200030001; and, Churchill Downs v. Commissioner

As per usual I'm swimming in areas where the tax code is seemingly at odds....

Richard S. Leyh et ux. v. Commissioner – Contemporaneous Log Detailing Rental Property Activity Permissible in Defining Real Estate Professional for Income Tax Purposes

Richard S. Leyh et ux. v. Commissioner (T.C. Summ. Op. 2015-27) details a case in...

Business Taxes Due Next Week – AVOID PENALIZATION – File An Automatic Extension Request TODAY – IRS Form 7004

The Business and Partnership Tax deadline is coming up fast! Don't sweat it! File IRS...

Can You Establish a SEP Plan if you are a Sole Proprietor? What if that Sole Proprietorship Had Historically Passive Income?

Regardless of their nature or topic matter, off beat questions are one of the spices...

2014 Depreciation Limits on Luxury Autos: IRS Rev Proc 2014-21

According to 26 U.S. Code § 280F - Limitation on depreciation for luxury automobiles the...

Take Care Closing Down An LLC – IRC 752 – Treatment of Certain Liabilities

A taxpayer reading one of my blog posts from Ishpeming, Michigan was compelled to call...