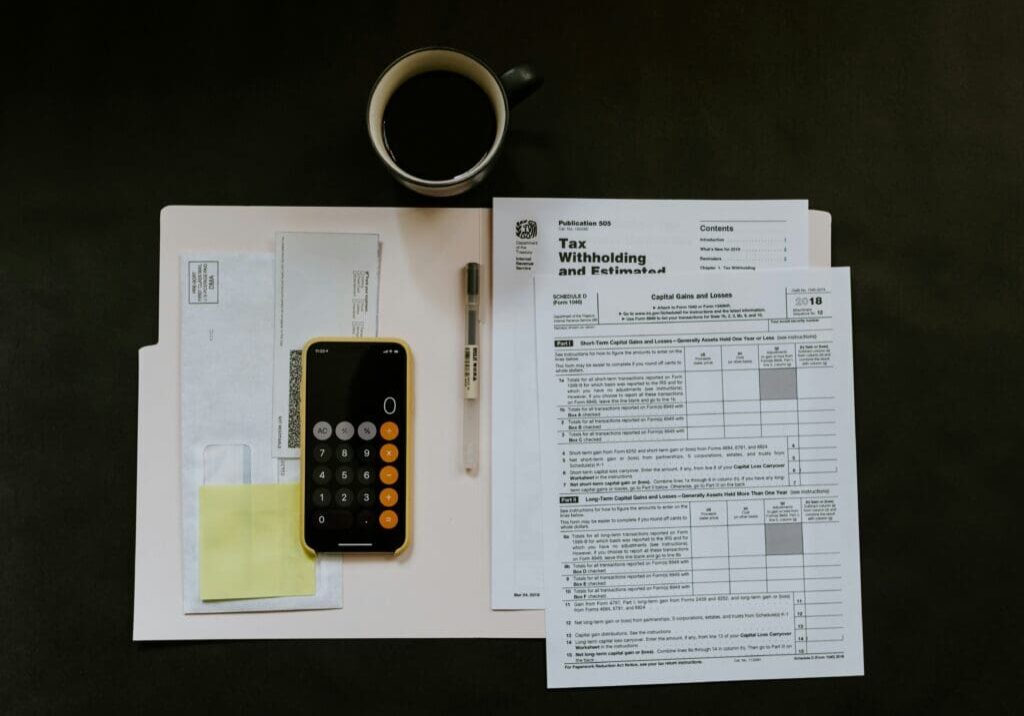

John R. Dundon II, EA

Colorado Tax Legislation 2024

Colorado Tax Legislation 2024 This post summarizes Colorado Tax Legislation 2024. It was drafted with...

US Savings Bonds Tax Implications

US Savings Bonds tax implications can be complex. If you inherited or were gifted US...

Baker v. IRS Commissioner – Medical Expense Tax Deduction for Continuing Care Payments

Baker v. IRS Commissioner - medical expense tax deduction for continuing care payments. The IRS...

Understanding IRS CP59 Notice

The IRS CP59 Notice alerts you that there is no record that your prior personal...

Sales Tax on Professional Services Rendered in Colorado

The Second Regular Session of Colorado's 73rd General Assembly starts January 5th, 2023, and when it convenes,...

Reasonable Compensation and the S Corp Owner

Reasonable compensation and the S Corp owner is a case study of a multiyear dispute...

DO SOLAR PANELS SAVE YOU MONEY AND HELP ADVANCE THE PLANETS WELL BEING? 1 USEFUL EXAMPLE.

Solar Panel Expenses Qualifying for Tax Credits. Do Solar Panels Save You Money and Help...

Colorado’s New MYUI+ Employer System

The Colorado Department of Labor & Employment Unemployment Division (CDLE-UI) introduced a new system for...