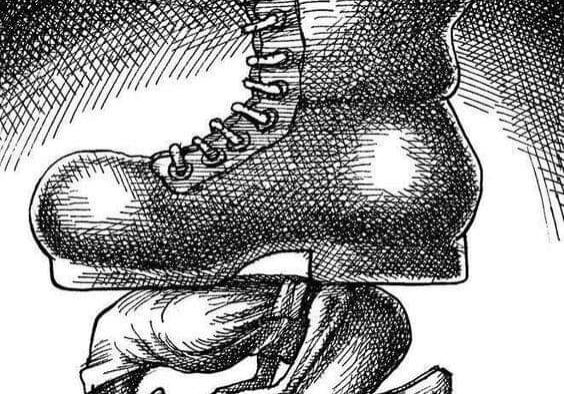

Tax Problems & Requests

First Day of Tax Filing Season, the IRS Ogden (Utah) Service Center is Hobbled – IRS Crisis

Monday January 24th 2020 was NOT a good first day of tax filing season, the...

Why You Should File Past Due Tax Returns NOW

Regardless of whether or not you are able to pay your tax liability in full,...

AVOID PENALTIES – Get Income Tax Extension Requests Filed & Estimated Income Taxes Paid

Remember your US Income Tax extension request is ONLY for additional TIME to FILE your...

Incorrectly Issued Health Insurance Marketplace Statement Relief – Form 1095A

I had a grEAt conversation with my friend Bob Kerr Friday. We talked about the...

Worker Classification & the Colorado Department of Labor & Employment

Worker Classification & the Colorado Department of Labor & Employment This post is about my...

A Brief Introspection of Repair vs. Improvement: IRS Revenue Procedures 2014-16 and 2014-17

That's right Y'all this is another one of those quite game changers for owners of...