Tax Court

U.S. Tax Court Settlements in IRS Appeals

In Notice 2015-72 the IRS proposes to update Rev. Proc. 87-24 regarding U.S. Tax Court...

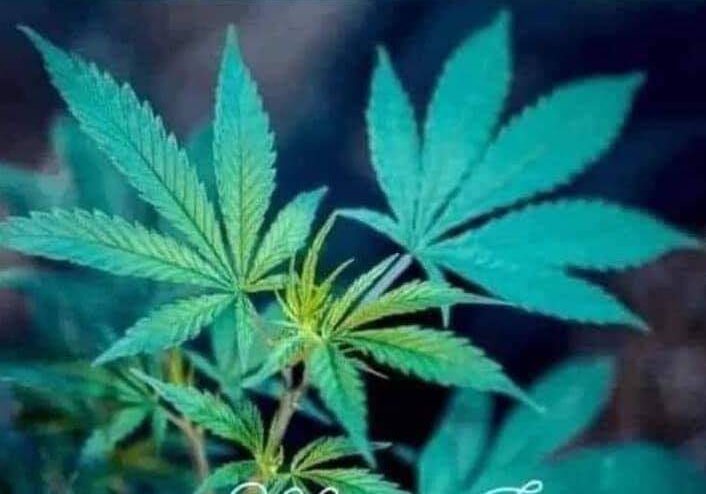

Marijuana Taxation: Beck v. Commissioner & Excise Tax Paid

UGH! I vowed to stop writing about the tax implications of marijuana taxation: Beck v....

Coca Cola’s Recent IRS Statutory Notice of Deficiency – a Tipping Point in International Transfer Pricing Enforcement

In Coca Cola's SEC 8-K filing last week we learned that the IRS issued a...

Meal Expense – Navigating Between Internal Revenue Code Sections 162, 274, 132; IRS Technical Advice Memorandum 200030001; and, Churchill Downs v. Commissioner

As per usual I'm swimming in areas where the tax code is seemingly at odds....

Richard S. Leyh et ux. v. Commissioner – Contemporaneous Log Detailing Rental Property Activity Permissible in Defining Real Estate Professional for Income Tax Purposes

Richard S. Leyh et ux. v. Commissioner (T.C. Summ. Op. 2015-27) details a case in...

Schumann v. IRS: Reg. 1.469-2(f)(6) – The Nuanced Relationship Between Passive Losses & Self Rental Gains

Schumann v. IRS: Reg. 1.469-2(f)(6) - The Nuanced Relationship Between Passive Losses & Self Rental...

Odujinrin v. IRS Commissioner Reinforces the Significance of Engaging a Reputable Enrolled Agent

In Wole Odujinrin v. IRS Commissioner the petitioner, a hematology oncologist who represented himself, did not...