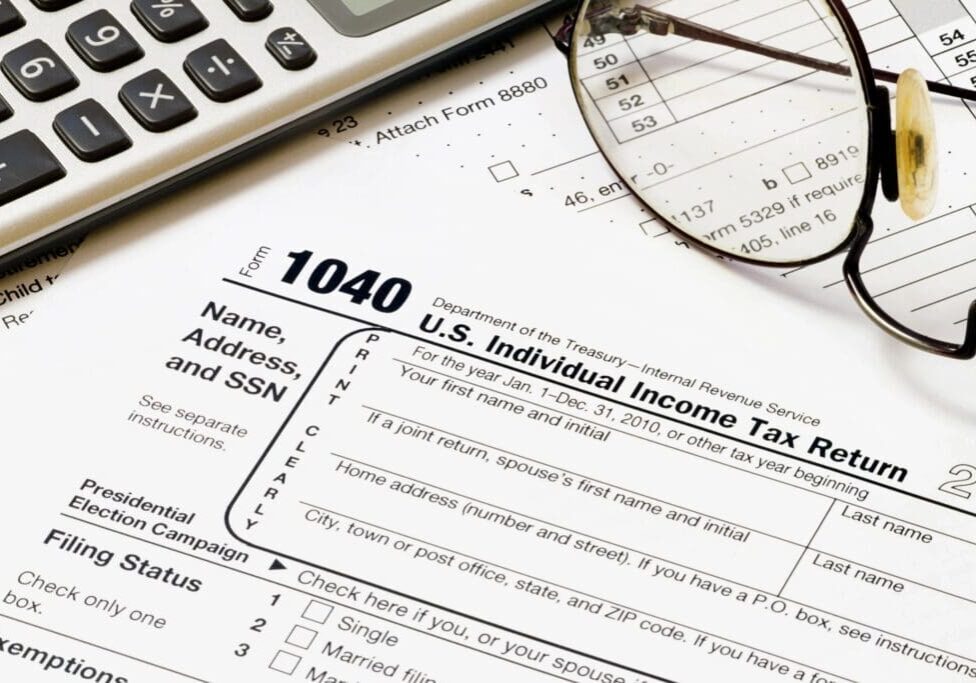

Tax Relief

First Day of Tax Filing Season, the IRS Ogden (Utah) Service Center is Hobbled – IRS Crisis

Monday January 24th 2020 was NOT a good first day of tax filing season, the...

U.S. Tax Court Settlements in IRS Appeals

In Notice 2015-72 the IRS proposes to update Rev. Proc. 87-24 regarding U.S. Tax Court...

IRS Audit Technique Guide for Entertainers

IRS Audit Technique Guide for Entertainers is for my many clients in the entertainment industry,...

US v. Clarke SCOTUS Decision Favors Taxpayers

The SCOTUS clarified the11th Circuit Court of Appeals in the United States v. Clarke Et....

Defending Against Alter Ego Allegations

What is an "alter ego" allegation? Aside of course being one of several nuanced yet...