Business Expense

Navigating Health Savings Accounts and Other Tax-Favored Plans

Over Thanksgiving I was asked to explain in basic sound bite terms the federal tax...

Health Savings Accounts (HSA) – A Fantastic Tax Planning Tool

Health Savings Accounts (HSA) - A Fantastic Tax Planning Tool - first introduced in 2003...

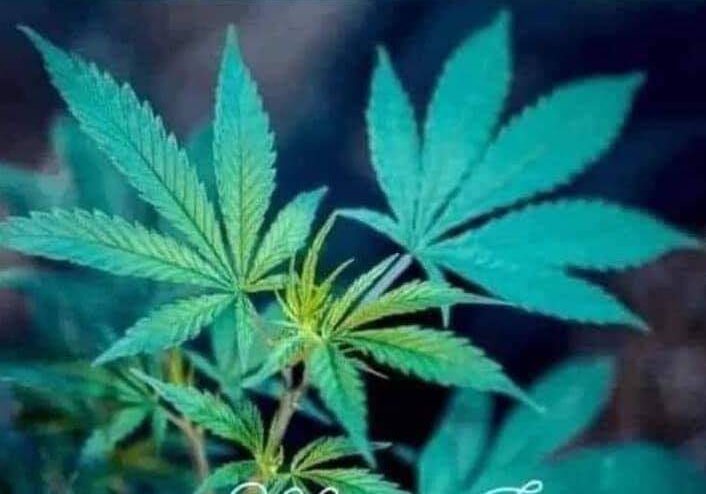

Marijuana Taxation: Beck v. Commissioner & Excise Tax Paid

UGH! I vowed to stop writing about the tax implications of marijuana taxation: Beck v....

Defining Small Employer with Regards to Offering Health Insurance

Many business owners of all sizes have been posting to this blog lately with concerns...

Meal Expense – Navigating Between Internal Revenue Code Sections 162, 274, 132; IRS Technical Advice Memorandum 200030001; and, Churchill Downs v. Commissioner

As per usual I'm swimming in areas where the tax code is seemingly at odds....

Business Taxes Due Next Week – AVOID PENALIZATION – File An Automatic Extension Request TODAY – IRS Form 7004

The Business and Partnership Tax deadline is coming up fast! Don't sweat it! File IRS...

Marijuana Dispensary Income Tax Guidance Update: IRS Memo 201504011

As many of you know who follow my tax musings via this blog, I recently...

Final Tangible Property Regulations Necessitate that Many Businesses Apply for Change Of Accounting Method: IRS Form 3115; Rev Procs 2015-13 & 2015-14

Back in June 2014 I blogged about the new IRS Regulations governing tangible personal property....