First Day of Tax Filing Season, the IRS Ogden (Utah) Service Center is Hobbled – IRS Crisis

Monday January 24th 2020 was NOT a good first day of tax filing season, the IRS Ogden (Utah) Service Center was Hobbled.

Is the stage being set for a proverbial $hit$how over the next several months? Was the IRS campus center housing all those servers hacked?

Who knows – hope not – but probably. Never mind the fact that, MILLIONS of tax returns from previous tax years remain unprocessed – many from tax year 2019 – it appears the predictions are coming to fruition for 2021 income tax reporting.

John Coffee said in The Green Mile “I’m tired boss, real tired.” Portrayed by the great Michael Clarke Duncan, it seems as though the lives of US tax practitioners all over planet Earth are becoming this character. It just started and I’m ALREADY tired.

- I’m tired of reading desperate posts on https://www.reddit.com/r/IRS/

- I’m tired of the messaging from the IRS brass to ‘be patient.’

- I’m tired trying to constructively engage IRS employees with low morale.

- I’m tired of the IRS floundering in CRISIS

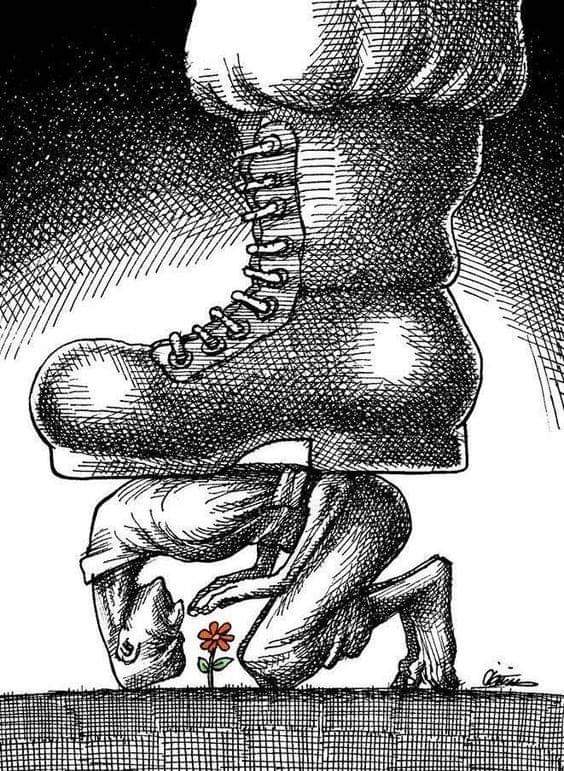

This CRISIS is HARMING our taxpayer rights

These four in particular:

- The Right to Be Informed

- The Right to Quality Service

- The Right to Finality

- The Right to a Fair and Just Tax System

As of December 31, 2021, the IRS’s backlog was unprecedented:

- ~6 MILLION unprocessed individual returns

- ~2.3 MILLION unprocessed amended individual returns

- ~1.1 MILLION unprocessed Forms 941, Employer’s Quarterly Federal Tax Return

In her 2021 Annual Report to Congress, Erin Collins, the National Taxpayer Advocate (NTA) did NOT hold back. Hitting the agency up with these juicy morsels:

- “There is no way to sugarcoat the year 2021 in tax administration. It was the most challenging year taxpayers and tax professionals have ever experienced – long processing and refund delays, difficulty reaching the IRS by phone, correspondence that went unprocessed for many months, collection notices issued while taxpayer correspondence was awaiting processing, limited or no information on the Where’s My Refund? tool for delayed returns, and – for full disclosure – difficulty obtaining timely assistance from TAS.”

- Since 2010, the IRS’s budget (when adjusted for inflation) has decreased 20%, its staff levels have fallen 17%, and individual and business returns have increased 13%.

- The IRS began the 2021 tax season behind by approximately 11.7 million returns from the previous tax year, according to the report. When the IRS closed the 2021 filing season, there were still 9.8 million individual returns in its Error Resolution System that required manual processing.

- Low-income families have been hit the hardest by delays, getting answers from the IRS has been near impossible.

- In fiscal year 2021, the IRS only answered about 11% of all calls, with wait times averaging 23 minutes.

- Some taxpayers who timely responded to IRS math error notices have been subject to automatic “premature” collection notices.

- While some may only be inconvenienced by their missing refund, many are experiencing “severe financial hardship,” the report says.

Proposed Solutions

In an NTA compilation of legislative recommendations intended to strengthen taxpayer rights and improve tax administration 68 legislative recommendations for consideration by Congress interestingly dubbed the Purple Book are documented – the following congressional considerations stand out.

- Provide sufficient funding for the IRS to improve taxpayer service and modernize its information technology systems.

- Extend the period for receiving refunds when the IRS postpones the tax filing deadline.

- Authorize the IRS to establish minimum standards for paid tax return preparers.

- Expand the U.S. Tax Court’s jurisdiction to hear refund cases.

- Restructure the Earned Income Tax Credit (EITC) to make it simpler for taxpayers.

- Amend IRC §6402(a) to prohibit offset of the Earned Income Tax Credit portion of a tax refund.

- Strengthen the Low-Income Taxpayer Clinic program.

Lip Service or Leadership?

Getting OUR federally elected senators and representatives to work in a bipartisan fashion for ALL of us. Efficient tax administration appears to be getting SOME traction for people in positions of ‘power’ on both ‘sides of the isle regardless of how they ‘swing’ the ‘proverbial’ axe. Who knows, between Feinstein, Connolly and Porter on the left with the Republicans Jacobs (NY) and Commissioner Rettig on the right maybe something can get done. For a drill down on any of this including the first Day of tax Filing Season, the IRS Ogden (Utah) Service Center is Hobbled – IRS crisis, contact me.

On a final unrelated not it is remarkable to think that Rettig was a Trump appointee considering all the new foreign languages introduced to the forms and otherwise accommodations to the immigrant community during his tenure.