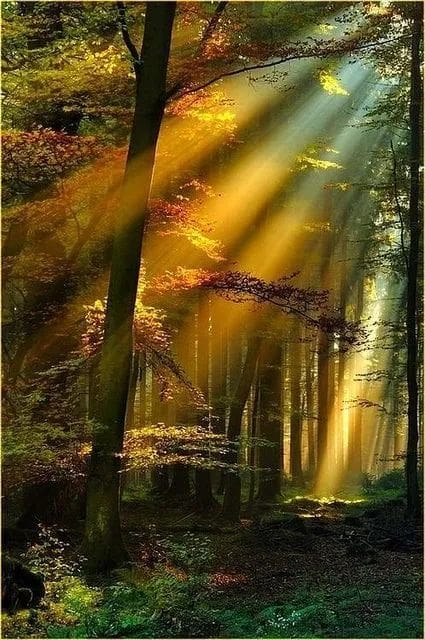

Deliberate Tax Free Compounding is the Secret of the Golden Flower

I am getting to be an old man now and so profoundly thankful that the lessons of tax-free compounding were impressed upon me at an early age. It has made a huge difference in my financial well being and subsequent happiness. You too can use the power of tax-free compounding to increase retirement savings. We all should.

Employer-sponsored retirement plans and individual retirement accounts among other tax favored savings vehicles provide tax-free compounding that can translate into more money for you when you retire. Simply put, compounding means earnings on previous earnings. Tax free compounding is IMHO the one true secret to establishing generational wealth.

Here is an example:

- Your account earns at a 12 percent annual percentage rate and provides monthly compounding at a rate of 1 percent per month (12% ÷ 12). At this rate, on an account with $100, you’ll have earned $1 ($100 x 1 percent) by the end of the first month and your new account balance would be $101.

- With monthly compounding, you’ll have earned $1.01 ($101 x 1 percent) at the end of the second month and your account balance would be $102.01. At the end of 12 months, your account balance will be $112.68.

- With a regular savings account, you will likely have to pay tax on your earnings in that account at the end of the year. If you pay the tax with money from that account, then less will be available for future earnings. Even if you don’t pay the tax with money from that account, you’ll have to come up with the money from somewhere else.

- Assume that the account in the above example is your regular savings account. Your balance is $112.68 by the end of the first year because you have earned $12.68 ($112.68 – $100). If your tax rate is 25 percent, you may have to pay $3.17 on the earnings of $12.68 ($12.68 X 25 percent).

- If you withdraw this amount at the end of the year to pay the tax, you’ll have $109.51 ($112.68 – $3.17) in the account for future earnings.

- Employer-sponsored retirement plans and IRAs provide compounding but offer the added advantage of tax-free compounding. This is because retirement plans and IRAs are tax-deferred accounts, and you generally don’t pay taxes on any earnings in these accounts until they are withdrawn.

- If you have an IRA or retirement plan account with a $112.68 in the account at the end of the first year, you are not taxed on the earnings of $12.68 until you withdraw them. If you keep the earnings in the account, you will have $112.68 left in the account for future earnings.

- It’s a mathematical fact that you earn more on a larger sum of money. That’s why a larger account balance at the end of the year means increased earnings during the following year. Over time, tax-free compounding means a significantly larger account balance.

Use the tax-free compounding power of retirement plans and IRAs to boost your retirement savings.Below are helpful resources on retirement topics on IRS.gov:

• Saving for retirement – information about the benefits of saving now for your retirement.

• Types of retirement plans – information about various types of employer-sponsored retirement plans.

• Retirement Plans FAQs – Answers to frequently asked questions about IRAs and retirement plans.

As a lifelong student of the US Tax Code I have had the pleasure of engaging and partnering with a diverse group of the most astute finance managers on both costs as well as here in Colorado where I am seen most often roping and riding. Hit me back if you would like a copy of my referral list.